Vancouver’s Housing Market is Gloomy – Yet Unaffordable For Household Incomes Of $120,000 Yearly

The housing numbers out of Vancouver, once among the world’s hottest real estate markets, are getting more dismal with each passing month.

Sales in April, 2019 were the lowest in 24 years for a month that typically kicks off the busy spring homebuying season. Benchmark prices are down 8.7 per cent from their peak in mid-2018 and the number of homes sitting on the market has ballooned by nearly half, according to the Real Estate Board of Greater Vancouver.

Yet those awaiting a final reckoning — and the chance to buy a home on the cheap in this picturesque West Coast city — may be disappointed, according to Tamara Vrooman, chief executive officer of Vancouver City Savings Credit Union.

“We see no evidence of a freefall,” Vrooman, 50, said in an interview at the headquarters of Canada’s largest credit union. “We have certainly seen a lot of sitting on the sidelines and wait-and-see, but we’re also seeing signs that we might be at the trough.”

Outlying suburbs and southern Vancouver Island, favoured by families and those able to work remotely or start businesses, are still seeing growth, she said. Developers are also starting to assemble lots and buy land again. One Vancity client recently tried to buy a commercial building in Vancouver listed for $20 million, but lost — the property sold for $26 million within five days after getting seven offers, she said.

Affordability Issue

Vrooman has a better insight than many: Vancity provides banking services for about a quarter of the people in the metropolitan area of 2.25 million. She’s well aware of the economic challenges facing borrowers and potential homebuyers in a city where the benchmark home price is still more than $1 million.

“We still have a huge affordability issue, of course, where it is still out of reach for household incomes of $100,000 or $120,000,” she said. “We don’t have the right mix of housing.”

Housing for families, such as two- and three-bedroom townhouses with a small yard, aren’t part of Vancouver’s housing supply, she said. Cheap rentals are also difficult to come by, even with Vancity financing the development of 3,000 affordable rental units in the past year.

“We still see affordability as the primary issue,” she said.

Brain Drain

With Canada’s rising household debt levels “perilously high,” more needs to be done to lift incomes that have stagnated for years within British Columbia’s real estate fuelled economy, according to Vrooman.

“Real estate has been our oil, in many ways,” she said. “It’s been the dominant factor in our regional economy.”

That has caused a “brain drain” of talent within the region into the property market, depleting other industries that could offer high-paying jobs and counter any downturn from real estate.

Nevertheless, Vancity has benefited from the real estate boom. During Vrooman’s 11 years at the helm, the co-operative has boosted assets 62 per cent while advancing its long-standing objective of upending the big banks in Canada’s third-largest city. The lender has 59 branches and 2,853 employees mostly in and around the Vancouver region.

Hearts, Minds

“We’re competing with the big banks for the hearts and minds every day,” Vrooman said of her competitors. “When we gain market share, though, we gain it from the banks, and two in particular — TD and RBC, because they’re the biggest ones.”

Like Canada’s big banks, she’s also seen a slowdown in mortgage lending amid more stringent rules and other measures in the last few years to slow B.C.’s overheated housing market.

“We have a speculation tax, we have a vacancy tax, we have a school tax — all of those are creating uncertainty,” she said.

Vancity has been countering the slowdown by focusing on mortgage renewals, capturing a 92 per cent retention rate for its home loans. The credit union is currently seeing 3 per cent to 4 per cent year-over-year growth in new mortgages, less than half the growth of three years ago.

“We see it returning to what we call more normal market conditions,” Vrooman said. “We see a slow but steady return to normal.”

Max’s Humble Comments:

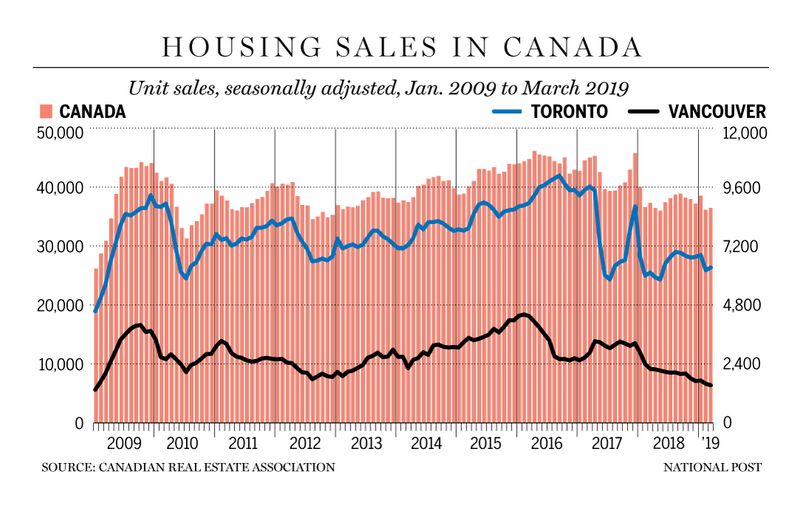

Is Toronto Real Estate Market following the Vancouver Real Estate Market? If it is, we are looking at a stagnant Toronto real estate market for a number of years in future.

The market pundits say that if the real estate prices go up too quickly for several years (as they happened in both Vancouver and Toronto real estate markets), then they will be followed by declining market prices for some years (market corrections).

But that is not happening in the Vancouver real estate market. As this report states, quote, “We see no evidence of a freefall,” Vrooman, 50, said in an interview. We have certainly seen a lot of sitting on the sidelines and wait-and-see, but we’re also seeing signs that we might be at the trough.”

In 2019, the Toronto Real Estate prices are decreasing slowly for detached houses over million dollar price range, but the prices are actually increasing somewhat for both condo townhouses and condo apartments.

And in 2019, the affordability of existing high prices is a big issue for both the first time buyers and the move-up buyers. And qualifying for new mortgages is more difficult now with the existing “Mortgage Stress Test” rules.

Yet, the mortgage rates are still quite low (5 yr mortgage rates are around 2.5% interest rate) and the mortgages are quite cheap since the bank rates are so low.

If prospective buyers are unable to qualify for the required large mortgages now, they will also be unable to obtain mortgages when the mortgage rates go up due to higher bank rates and higher 5-yr Canada bond rates.

So, we may be looking at stagnant yearly housing sales figures and stagnant or somewhat declining market for the Toronto real estate market in the coming years.

This is not good news for all prospective buyers who are renting at present.

This is also bad news to all renters, whether they are searching for affordable rentals or who are renting at present in Toronto and the GTA. In Toronto, we have an acute shortage of rental units for over twenty (20) years and Condo Apt. rental prices are going up quickly in Toronto and the GTA.

In Toronto real estate market, the pool of first time buyers who are qualified to obtain the requisite mortgages is shrinking because of ever increasing property prices. Also the majority of the renters with lower earnings may not have initial down-payments and do not qualify for the required mortgages.

As per Toronto Real Estate Board (TREB), there were 92,335 sales in Year 2017 and 78,019 sales in Year 2018. It could be over 80,000 sales in 2019.

Well, who benefited during the explosion of house prices during those 10 years? Mostly, they are all the homeowners and other types of property owners.

The house and condo builders, the real estate developers, the real estate agents, the mortgage lenders, the mortgage agents and other house construction and house sale related trades also benefited.

There were about 78,000 sales and over 53,000 TREB members in Year 2018 as per the records of the Toronto Real Estate Board (TREB). On average, every TREB agent did less than 3 sales (list side and/or sale side) in all Year 2018.

With the ongoing stagnant housing sales figures for the next several years, thousands of real estate agents will have little or no sales every year and may have to leave the industry. The real estate agents in Toronto and the GTA work in an intensely competitive market. They may or may not make sale every month and the commission earned may vary in every sale. As per the Competition Act, a real estate agent can charge any amount of commission he or she finds suitable including no commission at all in a sale. But they must pay their high yearly membership fees and marketing and operating costs.

Source: Financial Post

==================================================================================================

Thinking to sell your house or Condo in Central Toronto areas and/or in downtown Toronto areas? Please call, text or email Max Seal, Broker at 647-294-1177. Please visit http://www.TorontoHomesMax.com for a FREE Home Evaluation“.

Thinking to buy a House or Condo in Central Toronto areas and/or in Downtown Toronto areas? please call or text Max Seal, Broker at 647-294-1177 to buy your dream home or Condo. I offer you a 30-min “FREE buyer’s consultation” with NO obligation.

Please visit my website http://www.centraltorontorealestate.com/ to find out available homes and Condos for sale in Central Toronto areas and/or in downtown Toronto areas.

This Toronto housing market may be a better time for “Move-up”, “Move-down” or “Empty-nester” Sellers and Buyers. Want a “Market Update” of your home in 2019? Please click the image below or call or text Max Seal, Broker at 647-294-1177 or send an email.

Leave a Reply