In toronto real estate, a strong housing market is making Canadians wealthier, on paper, as the value of their homes outstrips a rising amount of debt.

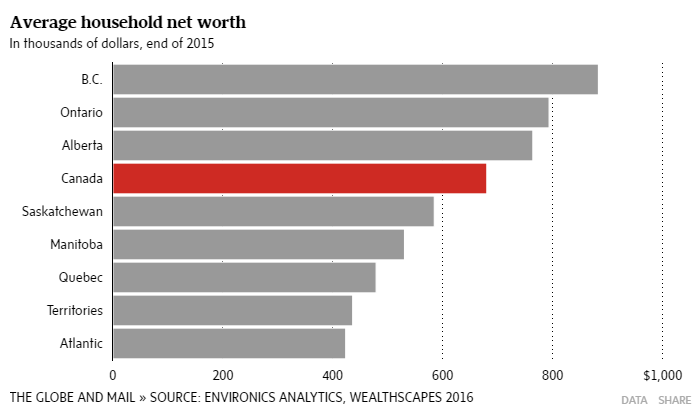

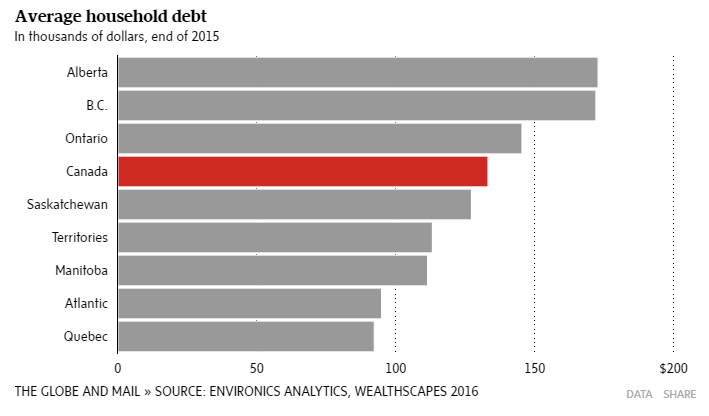

In toronto personal finance, household debt across the country grew by 4.1 per cent last year to an average of $133,170 while average household net worth increased slightly more, rising by 4.3 per cent to $680,098, according to the latest WealthScapes analysis by Environics Analytics. That leaves many households in decent financial shape despite challenging market conditions.

Households in British Columbia are the richest, according to the study, with net worth growing by 6.3 per cent to $883,049. Growth in B.C. was fuelled by a scorching hot real estate market centred on Greater Vancouver. In fact, Vancouver became Canada’s first “city of millionaires” with the average household net worth hitting $1,036,202, a 7.1-per-cent increase from 2014.

Real estate holdings – which include appreciation on existing homes as well as new investments – increased by 11.9 per cent in Vancouver, well above the national average growth rate of 4.6 per cent.

Home prices have run up so far in B.C.’s Lower Mainland that the provincial government recently imposed a 15-per-cent tax on foreign buyers of homes in some municipalities, in a bid to cool the market and resist a tide of capital from China and elsewhere.

While many Canadians became wealthier, those in oil-dependent provinces struggled and saw household net worth rise by weak levels – 1.1 per cent in Saskatchewan and 1.8 per cent in Newfoundland and Labrador – or even fall. In the case of Alberta, household net worth declined by 0.7 per cent.

After British Columbia, Ontario boasts the richest households, with net worth growing by 5.2 per cent to $793,338. Alberta, which was the second-richest province last year, saw household net worth decline to $763,812, dropping to third in the national rankings.

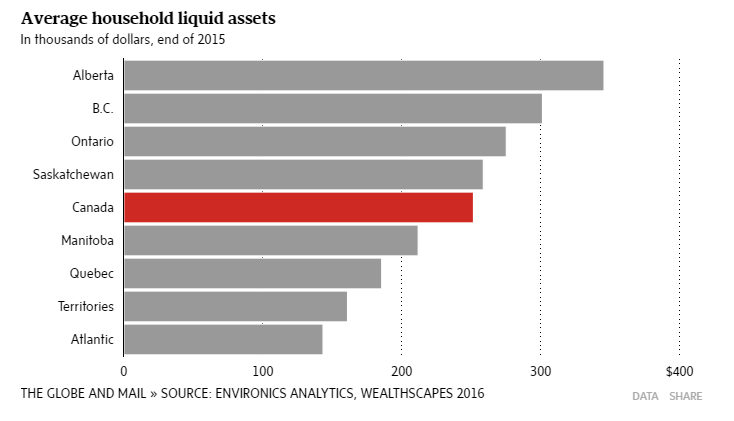

The average worth of liquid assets per household decreased in Vancouver, which Mr. Miron said suggests that some are cashing in their savings to make a down payment on real estate.

“The big worry on our radar at the moment is Vancouver,” Mr. Miron said. “It’s basically only real estate that’s fuelling growth in Vancouver.”

Conversely, the increase in Ontario’s net worth was spread among liquid assets, pensions and above-average real estate growth. While Toronto saw real estate growth contribute significantly to household net worth increases, households also experienced substantial gains with other assets.

Mr. Miron said there are no major indicators of volatility, but many questions regarding oil prices, the impact of B.C’s foreign buyer tax, and the possibility that the United States will raise interest rates.

Debt

Debt levels in 2015 grew at a slightly higher rate – 4.1 per cent – than in previous years, outpacing household income growth, which increased by 3.2 per cent.

However, the rising level of debt can be attributed to rising levels of mortgage debt, which increased by 5.1 per cent to $94,867. With historically low interest rates, Mr. Miron says it’s never been more affordable for Canadians to borrow.

“The big risk there is what happens if interest rates do start increasing,” he said. “Right across the board, Canadians would feel it. However, it would be concentrated in the areas which are more debt heavy, like for example Vancouver, Toronto and Calgary.”

Liquid assets

Despite a rocky year on the stock market, Canadian households on average managed to save more, with liquid assets increasing by 3 per cent to $251,559 in 2015. Investments – including bonds and segregated and mutual funds – made up a majority of those assets.

“This time around, we’re seeing Canadians being very cautious, particularly in areas related to taking on more debt,” Mr. Miron said. “At this point they are not very optimistic, which means they are being prudent, which can be considered both positive and negative.”

Pensions

Employer pension plans were the fastest-growing asset for Canadians on average in 2015.

Pension assets – predominantly within defined-benefit plans, where payouts are determined based on salary and years of service – increased 5.7 per cent nationally to $140,204. Pension assets grew the most in Manitoba – by 8.3 per cent to $142,740 – and in the Atlantic provinces, up 8.3 per cent to $138,804.

Mr. Miron said the increase appears to be tied less to new investments than to the appreciation in pension plan assets.

“With long-term interest rates continuing to decrease and Canadian longevity continually improving, it’s really forcing the defined-benefit pension plan values up,” Mr. Miron said.

Leave a Reply