Metro Toronto Real Estate Forecast 2020 Another Opinion

HIGHLIGHTS

|

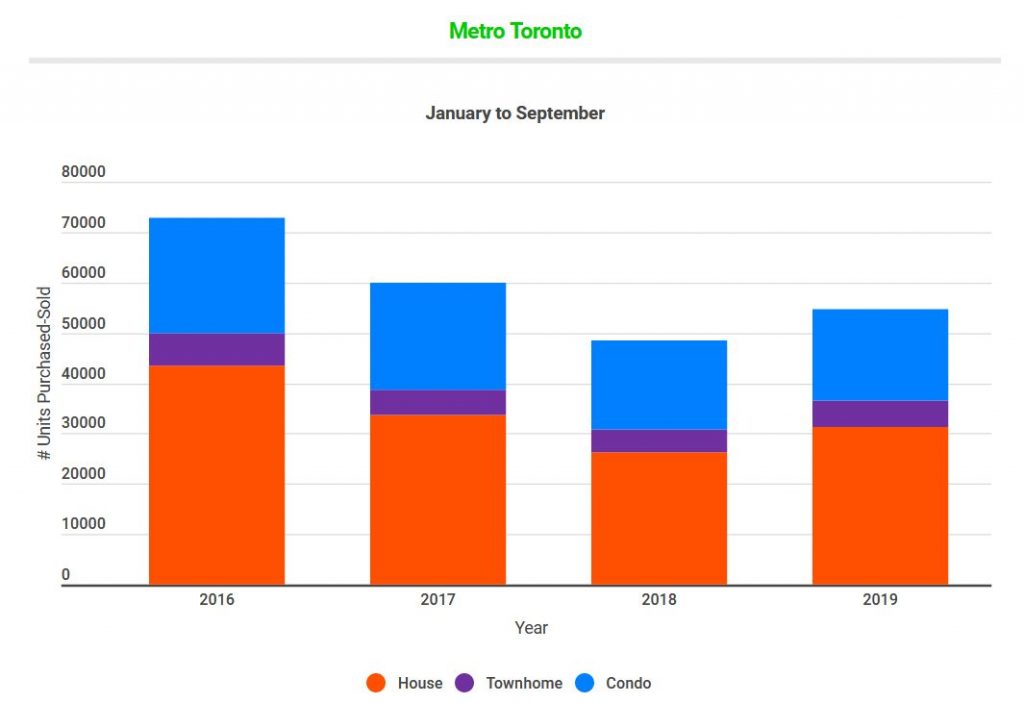

Even though prices are up, the number of people buying homes is down roughly 25% from 2016. Some people blame higher interest rates and tighter mortgage rules for the weaker market, but these arguments don’t hold much weight. Mortgage rates are still at rock-bottom lows and the market weakness began in 2017 when foreign buyer taxes came into effect rather than in 2018 with the introduction of the stress test. Toronto house prices have primarily weakened because foreign direct investment has shifted to Ottawa and Montreal.

Torontonians like to compare the local market to other global cities, so it is important to point out that most of Toronto’s market indicators are similar to those seen recently in San Francisco, Manhattan, Sydney, Stockholm, and London. These markets have weakened significantly and home prices have been dropping in what has been described as a synchronized global real estate slowdown.

This article covers:

-

Where are Metro Toronto prices headed?

-

What are Purchase and Listing Trends?

-

Should property investors sell?

-

Is this a good time to buy real estate?

1. Where are Metro Toronto prices headed?

Home Price Overview

There is bad news for homebuyers because prices are rising in Metro Toronto, and this pushes prices beyond the reach of a median Metro Toronto household with an income of $78,000 (before taxes). There is, however, a glimmer of hope for buyers as prices could drop this Winter.

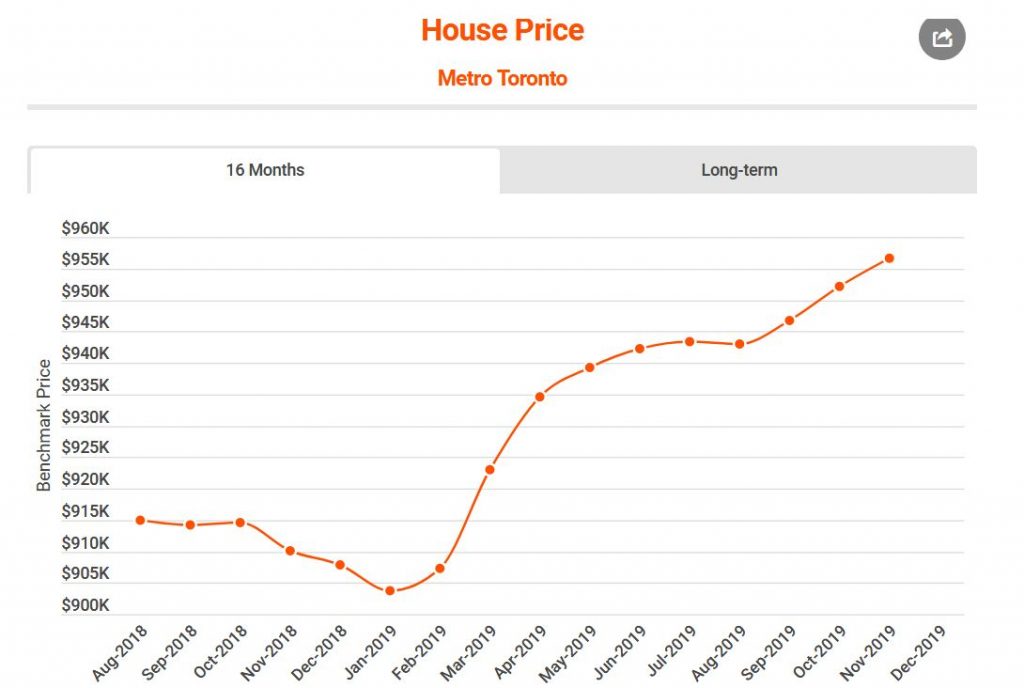

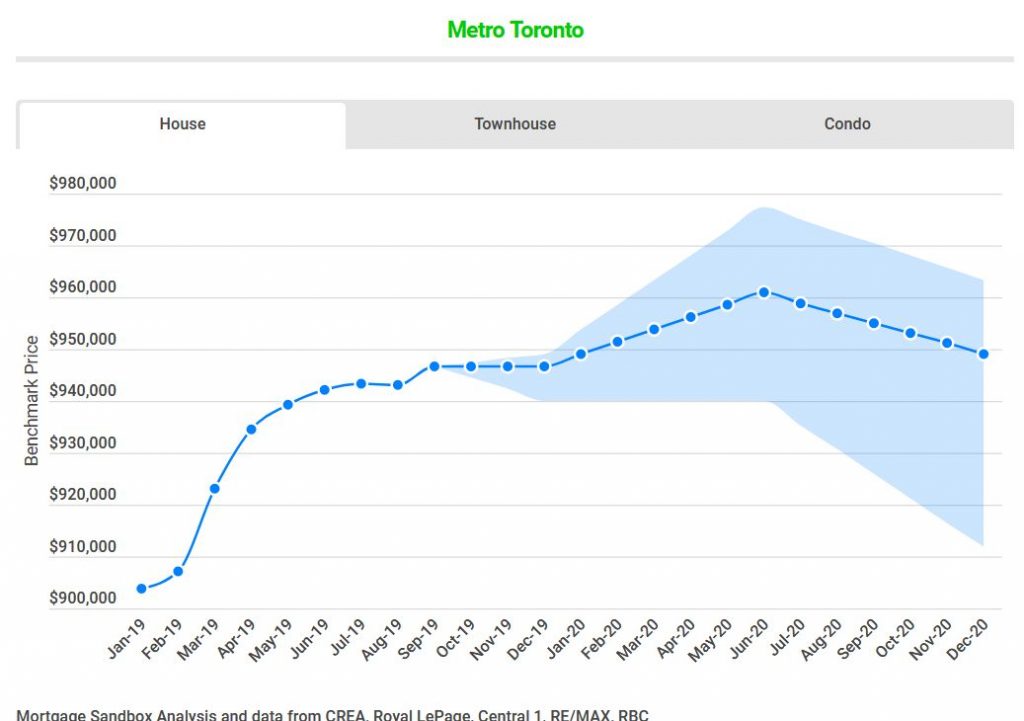

GTA Detached House Prices

Since the peak in 2017, Metro Toronto house prices have dropped roughly $100,000.

From the beginning of 2015, Metro Toronto house prices climbed $400,000 to a peak of $1.05 million. In 2017, house prices subsequently dropped $140,000 and only this year recovered $50,000 of the value lost in 2017.

Metro Toronto house prices are still down roughly $100,000 from the peak.

Metro Toronto house prices have shown a fair degree of unpredictability. Is it possible that prices may drop again between now and the end of 2020? If you’re looking to buy or sell your home in the next three years, you should pay close attention later in this article when we explore recent trends in buyer and seller behaviour.

Contrary to the flat overall house price trend, prices in high-end markets like Richmond Hill, Aurora, and Markham have stayed flat or dropped over the past year. This weakening at the top of the market may lead to softening in other areas.

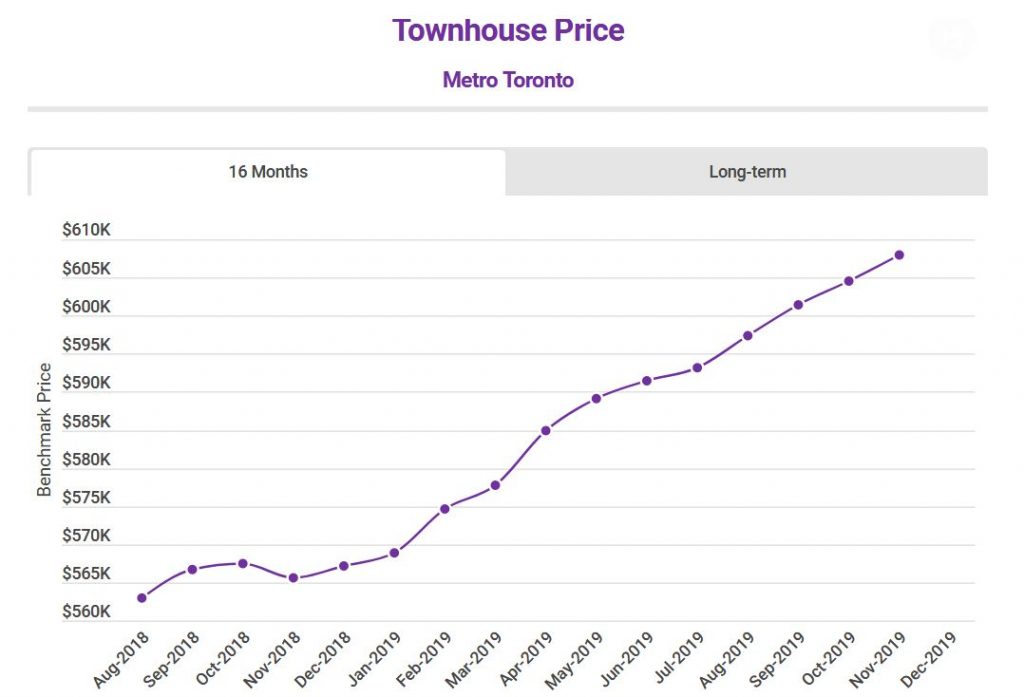

Metro Toronto Townhouse and Condo Prices are Flying High

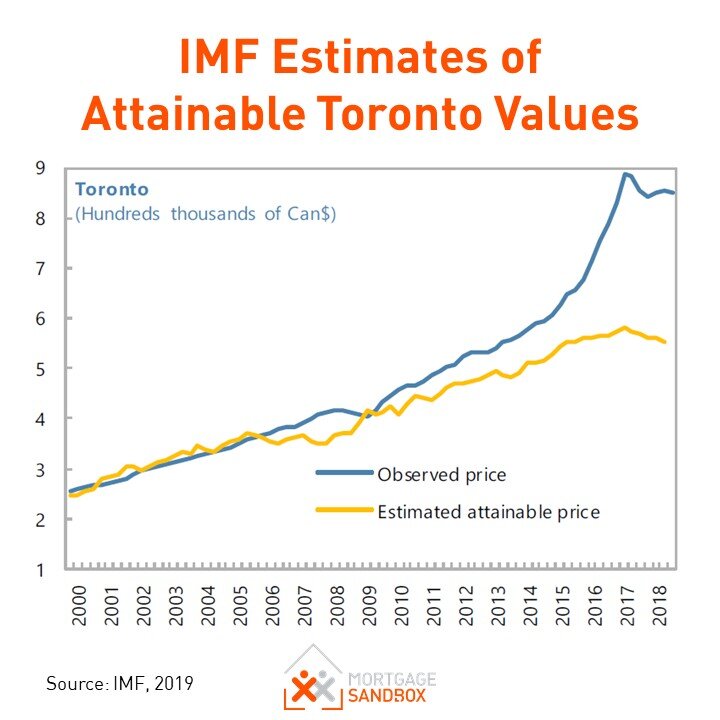

Metro Toronto condo prices skyrocketed since 2016 and continue to break new records. More bad news for first-time home buyers. Prices have outpaced any reasonable measure of affordability. At Mortgage Sandbox, we are concerned that Toronto is mirroring the 2018 Vancouver condo market which ran super-hot and has since lost 10% of its value. If the Toronto market was a slow steady market, we would consider it to be a lower risk. We expect prices to decelerate in the slow winter months. Today, the benchmark Metro Toronto condo is unaffordable for most without help from the bank of mom and dad.

Metro Toronto townhouse prices have mirrored condo price trends. Since 2017, house prices have dropped while townhouse prices have remained grown and the gap between the two has narrowed. For townhouse owners seeking to upgrade to a full house, this could be a great opportunity.

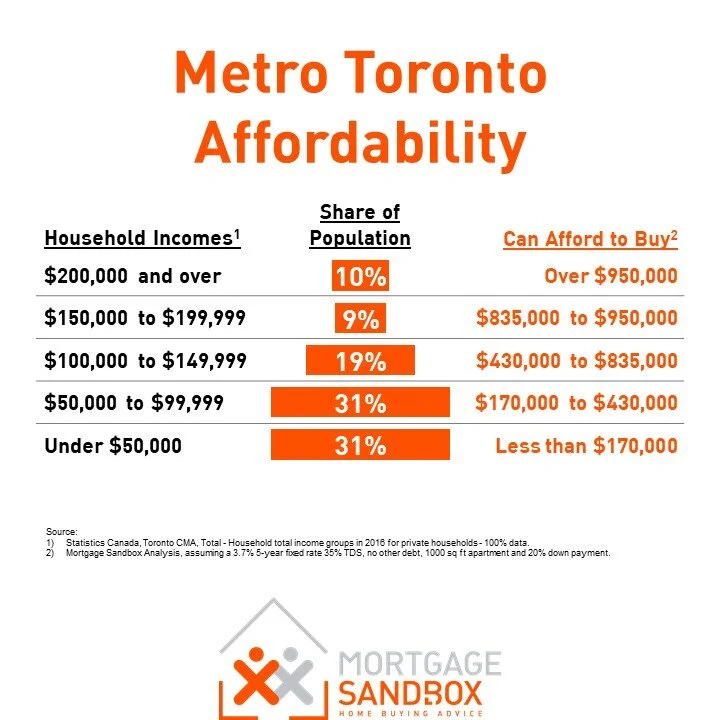

Still a challenge for first-time homebuyers

Although Toronto house prices have dropped significantly from the 2017 peak they are still not very affordable. Condos prices have pushed upward to levels that may not be sustainable. To put this into perspective, a first-time home buyer household earning $78,000 (the median Metro Toronto household before-tax income) can only get a $320,000 mortgage. This makes it painfully obvious that to buy an entry-level condo, a first-time homebuyer needs to save about $200,000 cash for a down payment or receive a very generous gift from mom and dad. For most people, that’s just not on the cards.

2020 Metro Toronto House Price Forecast

We expect 2020 to be a weak year for real estate the GTA, compared to 2019. The brunt of price drops will likely be felt by higher-priced properties (i.e., more expensive neighbourhoods and detached single-family houses). Condos likely won’t come out ahead by the end of the year.

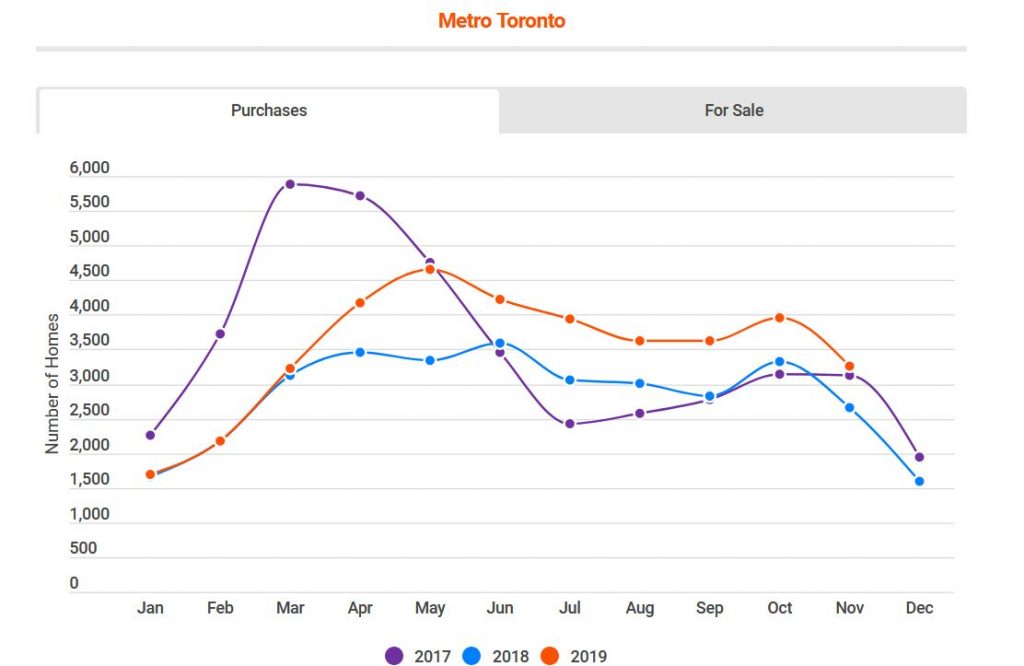

In our forecasts, we’ve factored in the seasonality of real estate. Prices are a little more resilient in the first half of the year and drop in the second half. This is because traditionally, there are more buyers and fewer sellers in Spring. In late summer and fall, more homes are for sale but buyers are more scarce so sellers often drop prices to complete a sale rather than wait until the next Spring.

Home Price Forecast to 2020

Given the forecasts, the current market weakness, and the increased downward price pressure, prices will likely remain flat or drop for the next few months. As well, homebuyers and homeowners shouldn’t expect much price appreciation between now and the end of 2020.

2. What are Purchase and Listing Trends?

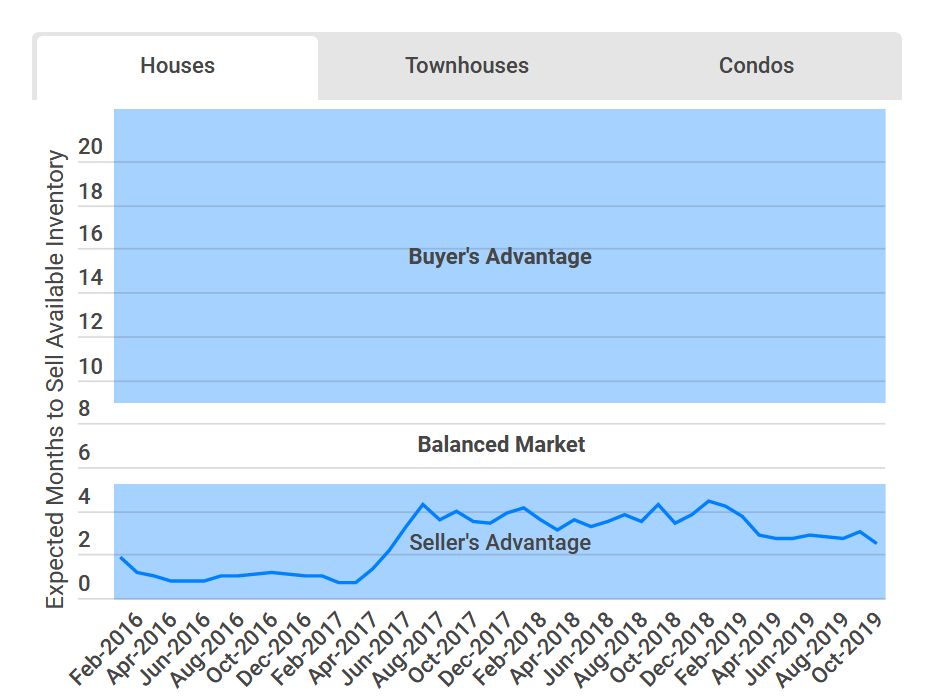

Solid Seller’s Market

Year-to-Date Home Purchases

What does this mean exactly? Well, the market for all homes (detached, townhome, condo) are all trending in a position where sellers have more negotiating power than buyers. This means that buyers have little opportunity to negotiate discounts and incentives. The negative outcomes for buyers are less selection (harder to find a home that meets all your needs), bidding wars, and ultimately a lot more stress.

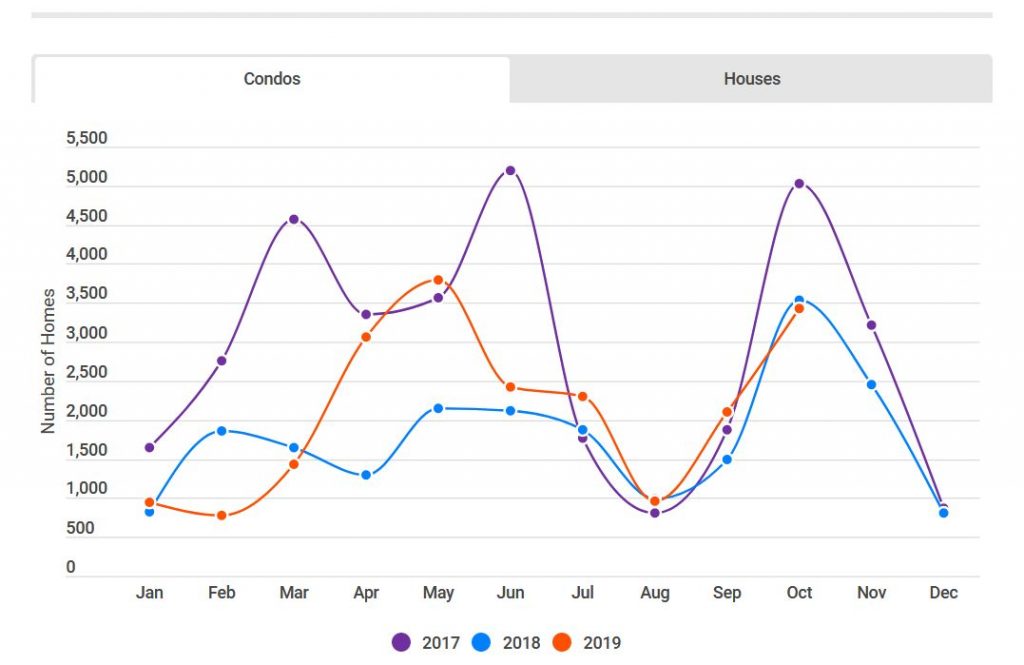

The condo and townhouse markets are the furthest into seller’s advantage. Meanwhile, the market for houses, which makes up most of the purchases in the GTA, has been trending deeper into a seller’s market.

A possible reprieve is if building construction completions (Metro Toronto has 74,000 homes under construction) brings enough new housing stock into the market to push it into a full-blown balanced market. If this were to succeed, we could see price discounts in late 2020- early 2021. Yay for first-time home buyers!

Home Supply Turnover

Metro Toronto

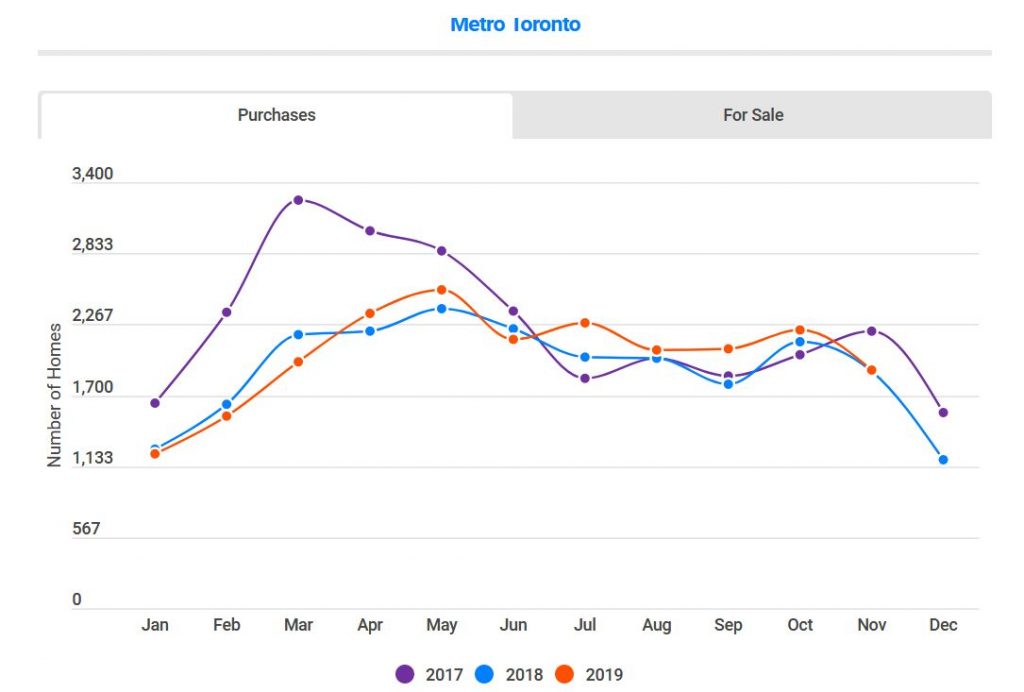

Purchase activity picks up – Are rental investors are crowding out homebuyers?

2019 began as another slow year for home purchases but buyer interest has picked up. Our research suggests that current prices are not affordable to people with local jobs regardless of how many people move to the GTA. As well, it appears rental investors are buying a large share of new condos and renting them out at a loss. They are banking on future price gains to make their investment pay off.

House Purchases vs. Active Listings

Condo Purchases vs. Active Listings

In contrast, the number of Toronto condo purchases (sales) has been slightly lower compared to previous years but we are seeing a dramatically lower supply of active listings. Basic economic theory tells us that we can expect this to lead to condo and townhouse price increases unless a lot of new supply comes to market to quench buyer demand.

A moderating in pre-sales reflects a more disciplined market

Pre-sales, which are purchases of brand-new homes from developers, have cooled off substantially compared to 2017 but are better than last year. Since developers need to sell at least 70% of a project to secure financing and begin construction, they may try to entice buyers with price discounts, move-in allowances, and cool amenities. Some developers have offered a bonus to realtors representing buyers who can convince their clients to buy!

Home Pre-Sales

Metro Toronto

The healthy Toronto pre-sales stands in contrast to the very slow Vancouver pre-sales. The slowdown in Vancouver may be symptomatic of the regulatory reporting differences between B.C. and Ontario. In February of 2019, B.C. instituted a pre-sale registry to catch people who flip pre-sales but don’t report the gains for tax purposes while Ontario has not implemented this measure.

Why are prices behaving this way?

At Mortgage Sandbox, we break down our market analysis to five key factors: affordability, capital flows, government policy, supply and popular sentiment. Read the full report to understand how these factors are affecting prices in Metro Toronto.

3. Should Investors Sell?

From a seller’s perspective, now is a better time to sell than in two years as CMHC, a Government of Canada Agency predicts that house prices will be flat or drop for the next two years.

To benefit from the best-case scenario, a home buyer should talk to their mortgage broker about prioritizing flexible loan conditions and mitigating risk. Find out more about the benefits of a mortgage broker.

Potential for a highly supplied market

There’s potential for an overwhelming surge in supply and this would bring more downward pressure on prices.

74,000 homes are under construction in Metro Toronto (51,500 in the City of Toronto) in February 2019, which are due to complete in 2020 and 2021. If a significant number of those homes were pre-purchased with the intention to flip them, they could bring a ton of supply to the market.

4. Is this a good time to buy?

2018 was a good time to buy because buyers had more negotiating power than in 2016. Supply has dwindled in 2019 but still better than 2016. 2020 may be even better. If enough housing stock comes to market and supply catches up with buyer demand, then bidding wars could become rare.

If you are thinking of buying just be sure to drive a hard bargain and cover your bases with smart and educated decisions. Don’t bite off more than you can chew. There are some inherent bubble risks in the market that buyers should be aware of as well.

Buying a home is a big decision, so check out Mortgage Sandbox’s Canadian Home Buyer Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Where will mortgage rates be by 2021?

===============================================================================================

Thinking to sell your house or Condo in Central Toronto areas and/or in downtown Toronto areas? Please visit http://www.TorontoHomesMax.com for a FREE Home Evaluation“ or please call, text or email Max Seal, Broker at 647-294-1177. NO obligation.

Thinking to buy a House or Condo in Central Toronto areas and/or in Downtown Toronto areas? please call or text Max Seal, Broker at 647-294-1177 to buy your dream home or Condo. I offer you a 30-min “FREE buyer’s consultation” with NO obligation.

Please visit my website http://www.centraltorontorealestate.com/ to find out available homes and Condos for sale in Central Toronto areas and/or in downtown Toronto areas.

This Toronto housing market may be a better time for “Move-up”, “Move-down” or “Empty-nester” Sellers and Buyers. Want a “Market Update” of your home in 2019? Please click the image below or call or text Max Seal, Broker at 647-294-1177 or send an email.

Leave a Reply