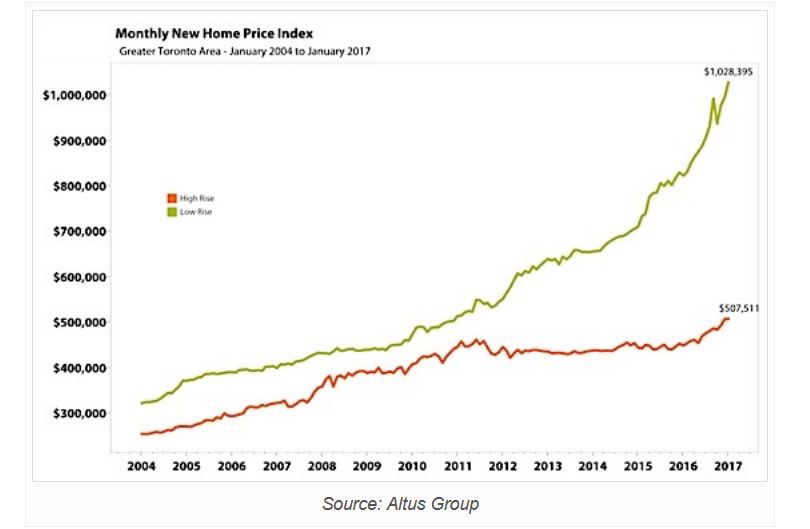

The gap between the average costs of newly created low-rise and high-rise residences in the GTA got wider again in January, 2017. A new single-detached home now costs twice as much as a stacked townhouse or condominium: $1,026, 395 to $507,551. The single-detached price is up 25 per cent compared to a year ago; the condo price is higher by 13 per cent.

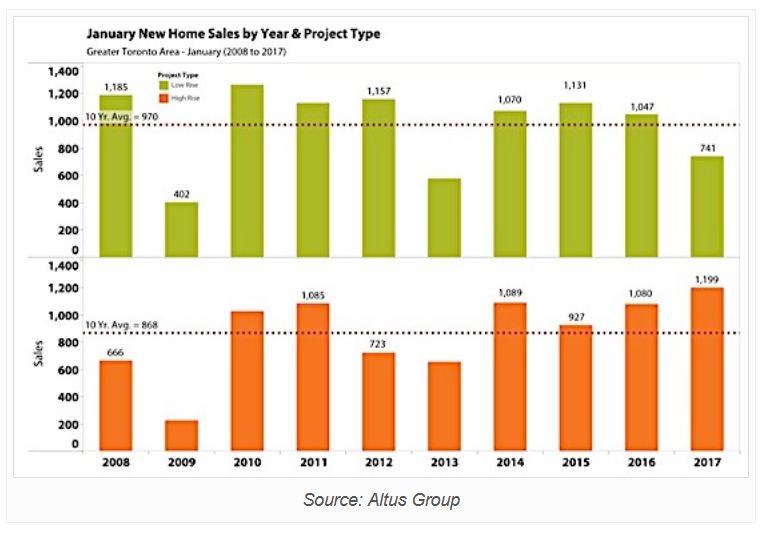

Not only prices but numbers of sales are diverging. New low-rise home sales were down in January, 2017, with merely 741 new residences sold, a lower of 29 per cent from a year ago. In Toronto, thirty-three new low-rise residences were sold in January. New condo sales ran the other space, rising 11 per cent, according to data provided by Altus Group for the Building Industry and Land Development Association (BILD).

Inventory of residences available for sale in both categories was also down, in the case of low-rise residences to a record low, with merely 1,524 ground-related residences for sale. The number of new condominiums for sale, though still relatively high with 11,529 units available, was nonetheless at its lowest in ten years.

Condominiums now make up 88 per cent of available inventory, noted BILD CEO Bryan Tuckey, who added that the GTA faces a “severe” deficit of housing supplying, with less than half the available inventory today than existed 10 years ago. Tuckey has regularly said that the severe shortage of housing, which is driving prices ever higher, is due to the lack of” serviced, developable property, excess red tape and frequent slows of new developments acceptance process.”

Our industry is implementing provincial plan by building more condominium suites and less ground-oriented dwelling. A decade ago condominiums represented merely 42 per cent of available inventory compared to 88 per cent in 2017.

Many agree with this analysis, includes the Ontario Real Estate Association( OREA ). That organisation’s CEO, Tim Hudak, listed five steps the Ontario government could take to alleviate the dwelling supplying difficulty in the GTA. One of these would be to give boroughs greater flexibility so that builders can build the kind of housing that people want, rather than fastening to “one-size-fits-all” growth plan.

Another positive step, Hudak argues in a piece in the Toronto Star , would be to address the “missing middle” of housing supplying. Rather than allow the polarisation of housing selection to continue–high-rise condo or single-family home–allow for such options as laneway dwelling, stacked flats and mid-rise constructs in areas that now restrict these types of housing. And it almost must be said that Hudak wants to see permissions process speeded up, unnecessary slows eliminated.

Economists agree that the government’s growth strategy, which emphasizes intensification rather than outward growth, has had an impact on the supplying of available low-rise residences in the GTA, particularly as some older residences on detached plenties are being torn down and redeveloped as condominiums. Nonetheless, Robert Kavcic, senior economist at BMO, believes that the area is not running out of property, citing Neptis Foundation estimates that there is enough property available to support fifteen more years of outward, land-related growth.

Greenbelt and smart growth preacher Erin Shapiro argued in a blog for Environmental Defence that the “real parts” held liable for rising home rates are low interest rates, demand for central locations, lack of housing options and lack of rental properties. Shapiro insists “they don’t have” deficit of available property available for progress, and poses the question, if developers are so concerned about affordability, “why is the majority of suburban development in the form of enormous residences selling at high prices?”

Source: Condo.Ca

Leave a Reply