Canada’s housing market has become riskier over the past two years, with risk levels similar to those seen during the financial crisis a decade ago, the International Monetary Fund (IMF) said in a report released this week.

But there is good news: The measures Canadian policymakers have taken over the past several years — particularly foreign buyers’ taxes and tough new mortgage rules — are the right ones to prevent a debt crisis, the report suggested..

In its latest Global Financial Stability Report, the Washington-based agency dedicated to global financial co-operation said the U.S. and Canadian housing markets have in essence traded places since the debt crisis a decade ago.

The U.S. housing market has a lower risk of crisis today, thanks to lower household debt levels and house prices that are better aligned with household incomes.

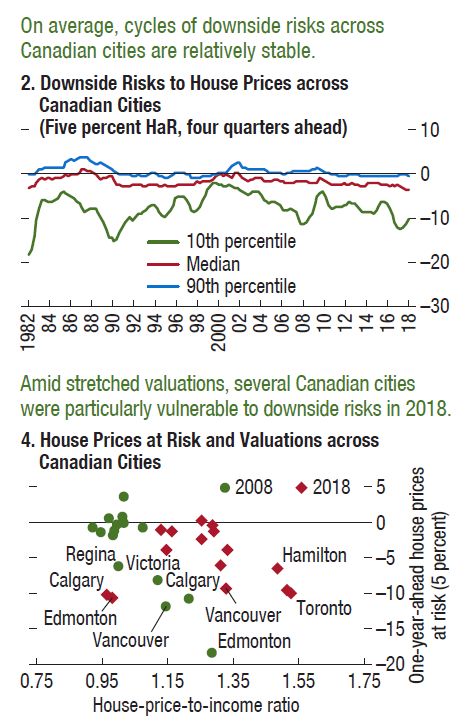

“In contrast, the housing market in Canada headed in the opposite direction, especially in such cities as Hamilton, Toronto, and Vancouver, where valuations look overstretched, much as in 2008,” the IMF report stated.

It argued many housing markets around the world are becoming less stable due to the inflow of cash from foreign buyers.

Certain types of foreign direct investment — such as when a real estate trust buys apartment buildings or a multinational construction firm sets up shop — can make housing markets more stable, the report said.

But money from foreigners buying individual homes “seem(s) to be associated with higher house prices in the short term and more downside risks to house prices in the medium term in advanced economies,” the report said.

The IMF’s research showed that foreign money has done more to destabilize the Toronto and Calgary housing markets than Vancouver’s market, which is generally thought of as being the most influenced by foreign money.

The foreign buyers’ taxes provincial governments introduced for the Toronto and Vancouver areas “might alleviate overvaluation pressure in these housing markets and reduce downside risks,” the IMF report said.

But the fact that different markets react differently to foreign buyers’ taxes suggests that “their broader impact may be limited,” the report added.

Another way to reduce risk in a housing market is through “macroprudential measures,” the IMF said, such as reducing how much homebuyers can borrow relative to their income.

That is what Canada’s banking regulator, OSFI, did when it introduced a mortgage stress test that requires borrowers, in effect, to qualify for a mortgage at a rate that is two percentage points higher than the one they are being offered. The test reduced the maximum amount homebuyers can borrow by around 20 per cent.

Canadian Real Estate industry wants looser rules

That stress test has become quite unpopular with the Canadian residential real estate industry, with numerous industry groups and real estate boards calling on the government to loosen or eliminate it.

They argue the stress test has shut out many would-be buyers from the housing market. Some in the industry have also called for the government to increase amortizations on insured mortgages to 30 years, from 25 years.

But other market observers have said those moves would do little to alleviate the country’s housing affordability crisis, and would instead push house prices up.

Source: HuffPost

Thinking to sell your house or Condo in Central Toronto areas and/or in downtown Toronto areas? Please call, text or email Max Seal, Broker at 647-294-1177. Please visit http://www.TorontoHomesMax.com for a FREE Home Evaluation“.

Thinking to buy a House or Condo in Central Toronto areas and/or in Downtown Toronto areas? please call or text Max Seal, Broker at 647-294-1177 to buy your dream home or Condo. I offer you a 30-min “FREE buyer’s consultation” with NO obligation.

Please visit my website http://www.centraltorontorealestate.com/ to find out available homes and Condos for sale in Central Toronto areas and/or in downtown Toronto areas.

This Toronto housing market may be a better time for “Move-up”, “Move-down” or “Empty-nester” Sellers and Buyers. Want a “Market Update” of your home in 2019? Please click the image below or call or text Max Seal, Broker at 647-294-1177 or send an email.

Leave a Reply